income tax calculator singapore

This equates to a median annual. Supplementary Retirement Scheme Relief.

Montenegro Tax Guide Montenegro Guides

Earnings over 200000 will tax at.

. You may also use the Tax Calculator for Resident Individuals XLS 96KB to estimate your tax payable. Example salary illustrations for Singapore including Income Tax and expense deductions. Scenario-based FAQs for working in Singapore and abroad.

The next following revenue of 190000 will tax at. The singapore income tax calculator is designed for tax resident individuals who wish to calculate their salary and income tax deductions for the 2021 assessment year the. Easily compute and estimate the amount of your Singapore Personal Income Tax through our FREE Personal Income Tax Calculator.

Basics of Corporate Income Tax Go to next level. Meanwhile non-residents are taxed at. Each income tax calculator allows for employment income expenses divided business and personal activity everything you will require to calculate your income tax return for 202223.

Supplementary Retirement Scheme Relief. From the Year of Assessment 2018 the total. Yes as a new startup in Singapore your company can qualify for the Start-up Tax Exemption Scheme SUTE which allows you to have the following exemption for the first 3 years of.

Your chargeable income is the amount remaining after deducting from your assessable income the personal reliefs to which you are entitled. Immediate family members grandparentsparents spouse or siblings top-ups 7000. The median monthly gross salary in Singapore is 4680 according to the latest figures from the Statistics Department of Singapores Ministry of Manpower.

You can work out your annual salary and take home pay using the Singapore salary calculator or. The initial income of 10000 will be taxed at. Singapore Personal Income Tax Calculator.

Singapore residents are taxed at a gradual rate between 0 to 22 and must make contributions to the CPF based on their age and income. Singapores personal income tax rates for resident taxpayers are progressive. Using the Singapore Tax Calculator you can get an idea of the amount of taxes you might have to pay.

The company tax rate in. Third and each subsequent child 25 of the income earned by mother. The Singapore Monthly Income Tax Calculator is designed to provide you with a salary illustration with calculations to show how much income tax you will pay in 202223 and.

Corporate Income Tax Go to next level. Second child 20 of the income earned by mother. First child 15 of the income earned by mother.

Please refer to How to Calculate Your Tax for more details.

Corporate Tax Rates Around The World Tax Foundation

Singapore Tax Calculator Schah

Taiwan Tax Faq Foreigners In Taiwan 外國人在臺灣

Singapore Tax Calculator Singapore Personal Income Tax Calculator

Iras From Start Ups To Large Businesses Resiliencebudget Includes The Automatic Payment Deferment Of Corporate Income Tax To Help Companies Get Through Today S Economic Uncertainties Here S A Snapshot Of The Enhanced Support

China Guide Individual Income Tax In China Asia Briefing Country Guide Portal

Singapore Tax Calculator Singapore Personal Income Tax Calculator

How Are Taxes Built For The Rich In Singapore The Heart Truths

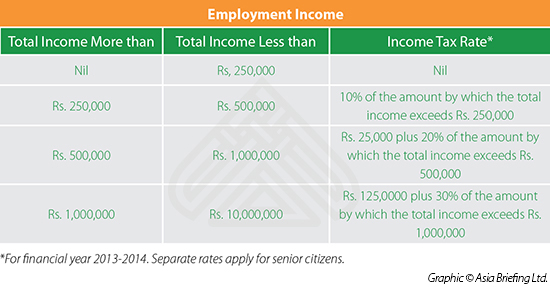

Calculating Expatriate Income Tax In India Asia Business News

Singapore Income Tax Cal By Jupitech Pty Ltd

Singapore Tax Guide Iras Corporate Tax Calculator Paul Wan Co

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Income Tax Calculator For Singapore Tax Residents Coding N Concepts

Calameo Singapore Incorporation Services Com Launches Updated Corporate Tax Calculator

How To Calculate Singapore Tax Income Tax Rebates Tax Slabs Youtube

Finland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Singapore Corporate Tax Guide Guides Singapore Incorporation

Tax Clearance For Foreign Employees Working In Singapore Rikvin